Our Solutions for your Business

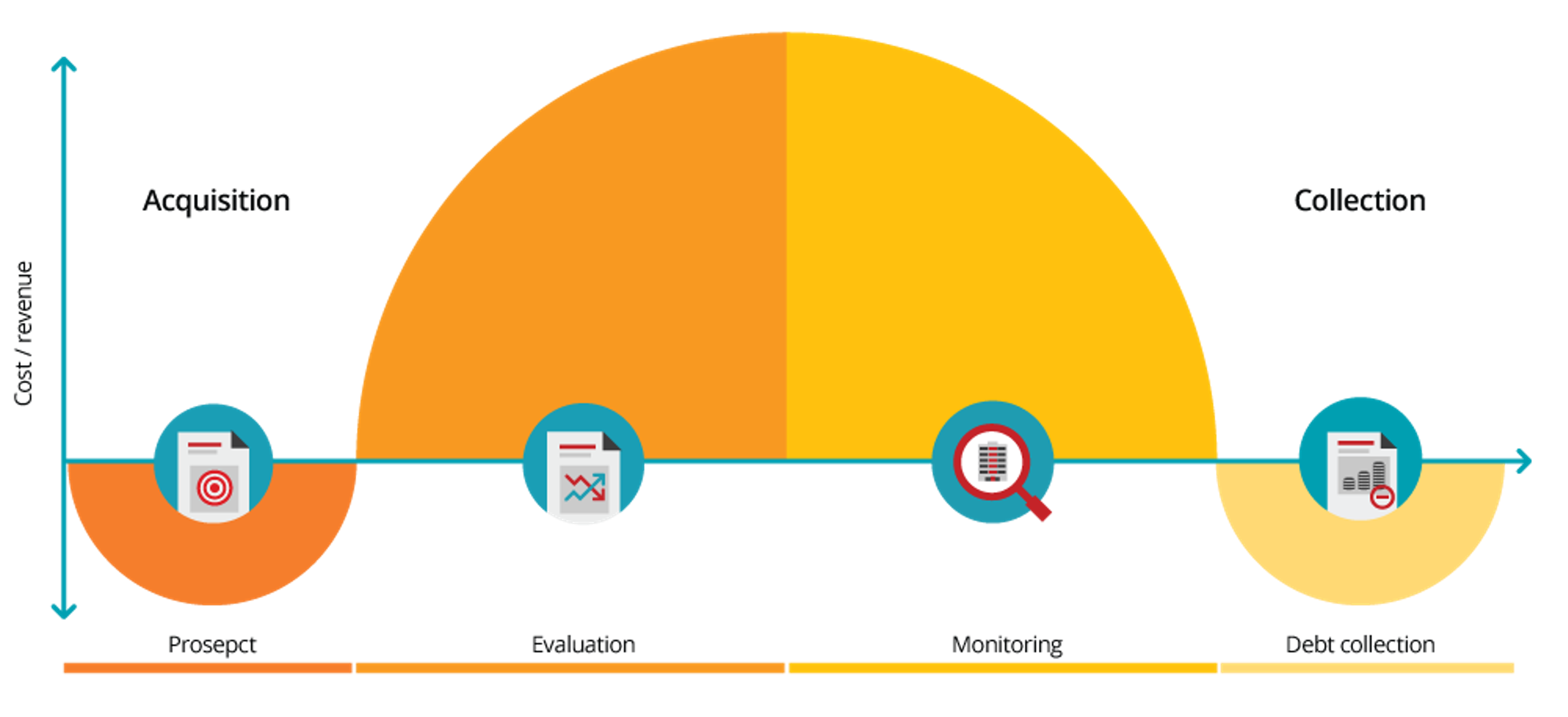

Improve your decision-making with advanced analytics. Credit risk scorecards are models that assess how risky your customers are during the credit cycle. These models rank customers based on data, enabling quick, accurate and clear decisions. Enhance your business with EveryData. Our experienced team has a proven track record of supporting companies across various industries worldwide, expanding financial inclusion.

Our Solutions for your Lending Business

Credit Report Plus

The EveryData Credit Report Plus is a comprehensive tool that increases your speed and efficiency in granting loan approvals. Inclusive of the benefits of our AI-based Credit Scoring model, Credit Report Plus draws on our credit information database to paint a complete picture of prospective borrowers' creditworthiness.

Market Insights

EveryData's Market Insights is a suite of reports, graphs, and statistics that show your performance across key measures for sales activity and delinquency relative to your industry. It gives insights into the general market performance and makes comparisons with your competitors.

Instant Decision Module (IDM)

Bring decision-making in your lending institutions to a whole new level with EveryData's IDM product. This decision engine provides a fully-automated workflow with connectivity to different information sources in order to pull the data and makes recommendations on whether to approve or deny loan applications. Sign up today for access to these summarized, customizable reports, inclusive of calculated ratios, applied policy rules, recommended credit limits, and more.

Portfolio Monitoring

Your customers’ credit status constantly changes, and, by monitoring these changes, you can make more-informed business decisions and identify new opportunities. With EveryData’s Portfolio Monitoring service, you can enhance your risk management processes, protect yourself from losses and increase low-risk sales. You will be instantly notified of changes to the customer profile allowing you to make optimal business decisions proactively.

ID Verification

Today’s ID-checking processes offer sophisticated, real-time verification methods so that you can quickly spot ID fraud without inconveniencing genuine customers. Our Digital Onboarding solution also brings you a completely customizable KYC process built around automated Identity Validation & Verification according to industry next and best practices.